BlackRock Bitcoin ETF Options Debut Fuels Market Optimism Amid Record Inflows

In a pivotal moment for cryptocurrency markets, BlackRock’s Bitcoin ETF options launched this week to a resounding response, with trading volumes and investor enthusiasm painting a bullish outlook for Bitcoin. The product attracted over $445 million in inflows on its first day and a staggering $1.9 billion in trading volume, reflecting growing institutional and retail appetite for exposure to the leading cryptocurrency.

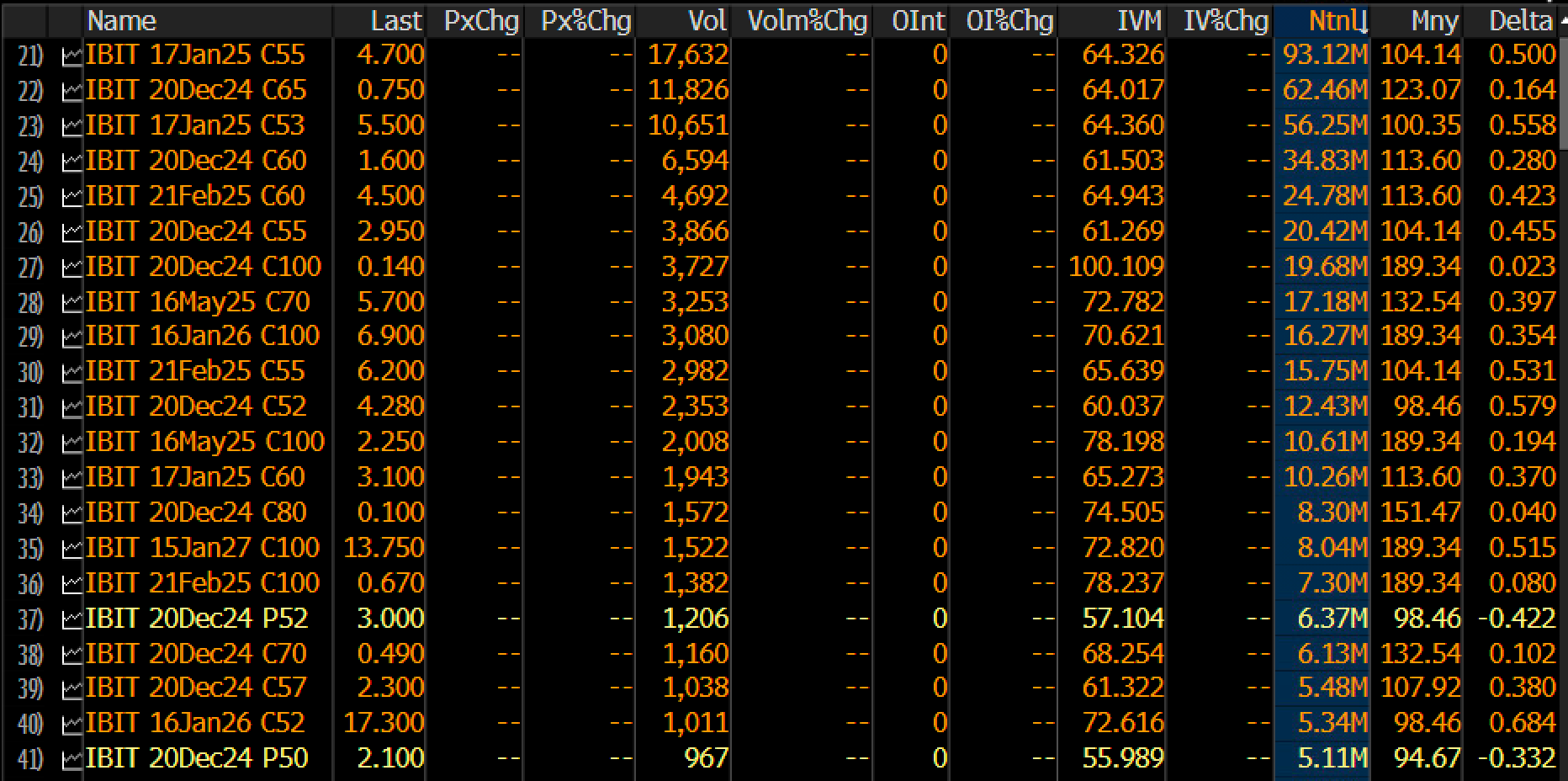

The launch of Bitcoin options for BlackRock’s iShares Bitcoin Trust (IBIT) ETF drew immediate interest, with most contracts positioned as call options—bets on Bitcoin’s price rising. ETF analyst Eric Balchunas described the day-one activity as exceptional, calling it “a ton for Day One,” with particular attention on a December 20 expiry contract targeting a Bitcoin price of $114,000.

“This level of activity underscores the market’s confidence in Bitcoin ending the year on a strong note, potentially above the $100,000 milestone,” said Joe Constori, head of growth at Theya.

The dominant presence of call options indicates a bullish sentiment that aligns with Bitcoin’s recent momentum, which saw the cryptocurrency hit a historic high of $97,792 earlier this month.

Institutional participation has been a key driver in Bitcoin’s ascent, with options providing a sophisticated mechanism to engage with the market. Alex Thorn, head of research at Galaxy Digital, noted that the introduction of derivatives like options could significantly expand market liquidity.

“Derivatives markets in equities and commodities dwarf their underlying spot markets. Bitcoin options could similarly transform the crypto market, offering greater liquidity and opening the door for even larger institutional positions,” Thorn said during a Bloomberg Television interview.

Bitcoin options present diverse opportunities for investors. Unlike directly owning Bitcoin, options offer flexibility through various strategies:

- Risk Management: Buying put options to hedge against potential price declines.

- Leveraged Speculation: Making outsized bets on price increases with minimal capital via call options.

- Income Generation: Selling covered calls on ETF holdings to earn premiums during periods of price stability.

This versatility has broadened Bitcoin’s appeal beyond speculators, attracting institutional investors and individual traders alike.

While the enthusiasm surrounding Bitcoin options is palpable, experts caution against overconfidence. The speculative nature of options trading can amplify risks, particularly for inexperienced traders drawn by the potential for significant returns. Outlandish price bets, such as Bitcoin reaching $170,000, could set unrealistic market expectations.

Moreover, the introduction of options could increase market volatility. As Thorn observed, the combination of heightened activity and large institutional bets can lead to rapid price swings, a hallmark of cryptocurrency markets.

The debut of Bitcoin ETF options signals a new phase of maturity for the cryptocurrency market. The tools not only legitimize Bitcoin as an asset class but also integrate it more deeply into traditional financial markets.

As Bitcoin flirts with the $100,000 milestone, options trading is likely to play a pivotal role in shaping its trajectory. While risks remain, the increased liquidity and institutional adoption stemming from products like BlackRock’s IBIT options point to a more robust and dynamic market ahead.

For now, the message from investors is clear: optimism reigns supreme as Bitcoin enters a potentially transformative era.