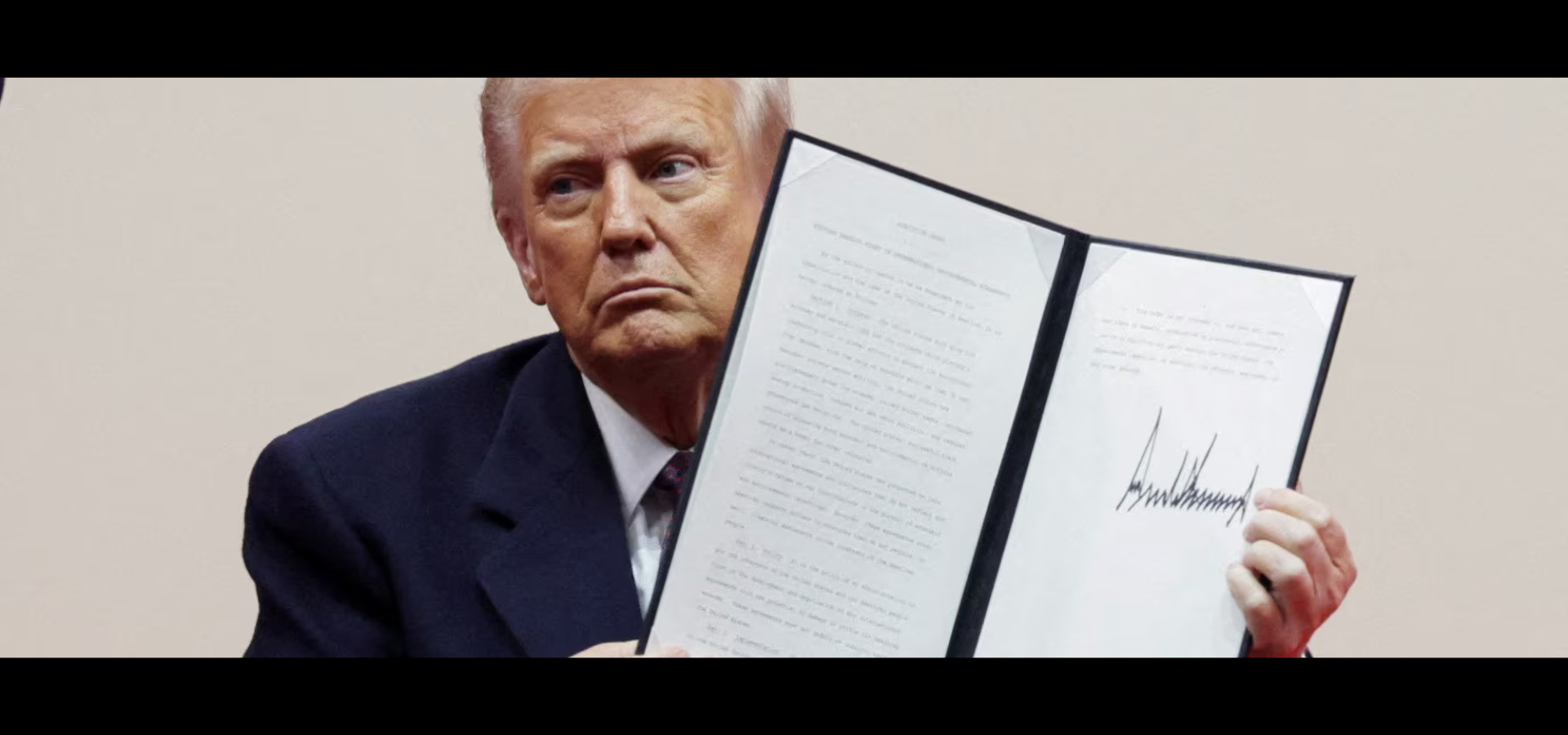

Trump Signs Executive Order to Reshape U.S. Crypto Policy and Innovation Landscape

In a significant step toward shaping the United States’ crypto landscape, President Donald Trump signed his first executive order on digital assets Thursday, establishing a Presidential Working Group on Digital Asset Markets. The directive outlines an ambitious vision for crypto regulation, innovation, and the exploration of a national digital asset reserve.

Key Points of the Executive Order

The executive order, titled “Strengthening American Leadership in Digital Financial Technology,” tasks the newly formed working group with crafting a regulatory framework for digital assets, addressing challenges around blockchain technology, and evaluating the potential creation of a national stockpile of digital assets.

The working group will be chaired by David Sacks, a prominent Silicon Valley venture capitalist and Trump’s newly appointed “crypto and AI czar.” Other members include the Secretary of the Treasury, the Attorney General, and the heads of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), alongside other federal leaders.

The order explicitly bans the development of central bank digital currencies (CBDCs) by federal agencies, reflecting a stance that aligns with concerns from Republican lawmakers about privacy and government overreach.

The Vision for a National Crypto Stockpile

One of the order’s standout proposals is the consideration of a “strategic national digital assets stockpile.” This initiative aims to explore the storage and use of cryptocurrencies seized in law enforcement actions, a concept that mirrors legislation like Senator Cynthia Lummis’ Bitcoin Act, which advocates for state-level Bitcoin reserves.

However, the executive order notably refrains from mentioning Bitcoin or any specific cryptocurrency, leaving the scope of the stockpile undefined. Despite the ambiguity, the proposal has bolstered optimism within the crypto industry, with Bitcoin briefly surging past $106,000 following the announcement and pulling back to $102,000 not long after.

Protecting Crypto Activity and Innovation

The executive order includes provisions to safeguard the rights of Americans to transact, mine, and self-custody digital assets while encouraging innovation in blockchain technology. It also pledges to shield crypto companies from banking restrictions and regulatory uncertainty, addressing long-standing frustrations within the industry.

Additionally, Trump’s order revokes the 2022 crypto executive order issued by former President Joe Biden, which had focused on curbing potential risks associated with the sector. The repeal signals a clear pivot toward fostering growth and adoption in the digital asset space.

Potential Challenges and Next Steps

While executive orders cannot directly mandate changes to laws or regulations, they set the tone for federal agencies and Congress. The Presidential Working Group has been tasked with reviewing existing crypto regulations within 30 days and presenting new recommendations within 180 days.

However, legal experts note that Congress and independent regulatory bodies, such as the SEC, are not obligated to follow the directives outlined in the order. Nevertheless, Trump’s allies in the Republican-controlled Congress are likely to support these initiatives.

Senator Tim Scott, the new chairman of the Senate Banking Committee, expressed optimism about the executive order. “I look forward to partnering with President Trump and his team to bring clarity, choice, and opportunity to this important sector of our 21st-century economy,” Scott said.

Industry Implications

Trump’s directive has generated cautious optimism within the crypto sector. Advocates hope it will dismantle barriers imposed during the Biden administration, which was characterized by aggressive enforcement actions against crypto companies. The SEC, under Trump’s new administration, has already formed a crypto task force led by pro-crypto Commissioner Hester Peirce to develop clearer and more inclusive regulatory frameworks.

As the working group begins its efforts, the U.S. crypto industry could see significant shifts in its regulatory and operational environment. Whether Trump’s bold vision will lead to lasting change remains uncertain, but the executive order marks a pivotal moment in the evolving relationship between digital assets and the federal government.