Bitcoin ETFs Worst Day as Investors Pull Over $1 Billion

Bitcoin exchange-traded funds (ETFs) just suffered their worst day on record for withdrawals, as a convergence of negative forces sent shockwaves through the crypto market. On February 25, 2025, investors yanked more than $1 billion out of Bitcoin-backed ETFs – the largest single-day outflow since these funds debuted. The massive one-day exodus underscores how rapidly sentiment has soured in the face of macroeconomic jitters, a major crypto exchange hack, and mounting risk aversion across financial markets.

Record Outflows Rock Bitcoin Funds

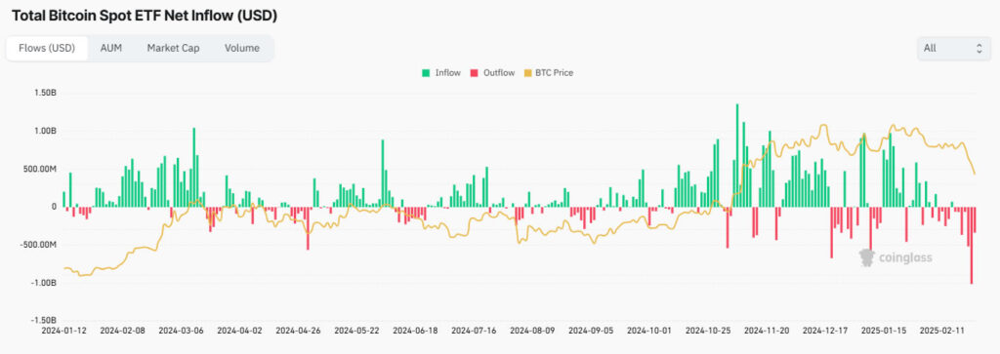

U.S. spot Bitcoin ETFs saw roughly $1.1 billion in net outflows on Tuesday, Feb. 25, a record retreat of assets in a 24-hour span. This eclipsed the previous peak of about $672 million set during a late-2024 sell-off. It also far exceeded the prior day’s withdrawals of $539 million, which had already ranked among the highest on record. The six-day losing streak leading up to Tuesday’s rout swelled the week’s cumulative ETF outflows to over $1.6 billion, capping off what analysts say has become one of the worst months ever for the category. In fact, Bitcoin ETFs have shed more than $2 billion in assets throughout February – a dramatic reversal after a period of strong inflows early in the year.

Daily net flows for spot Bitcoin ETFs (green for inflows, red for outflows) from early 2024 through Feb. 2025. Late February shows a sharp spike of outflows, marking the worst day on record.

Multiple large funds bore the brunt of the investor exodus. According to Farside Investors data, the biggest withdrawals on the record day included:

- Fidelity’s Wise Origin Bitcoin Trust (FBTC) – roughly $344 million redeemed

- BlackRock’s iShares Bitcoin Trust (IBIT) – about $162 million pulled (equating to around 5,000 BTC in one day)

- ARK 21Shares Bitcoin ETF (ARKB) – approximately $126 million in outflows

- Bitwise Bitcoin ETF (BITB) – over $85 million withdrawn

- Grayscale Bitcoin Trust (GBTC) – about $66 million redeemed

- Invesco Galaxy Bitcoin ETF (BTCO) – roughly $62 million in redemptions

Several other Bitcoin fund issuers – including Valkyrie, WisdomTree, VanEck, and Franklin Templeton – also saw tens of millions in withdrawals. Altogether, investors pulled over $1 billion from 11 Bitcoin funds on that single day, an unprecedented “largest-ever day of exits” for the nascent Bitcoin ETF sector.

Why Did Investors Rush for the Exits?

A perfect storm of macroeconomic anxiety and crypto-specific shocks fuelled this rapid sell-off. Observers point first to worsening investor sentiment in the face of new economic headwinds. Signs that the once-resilient U.S. economy may be faltering – combined with aggressive trade tariff moves – have rattled markets. President Donald Trump’s administration recently reaffirmed plans to impose steep 25% tariffs on imports from key partners like Canada and Mexico in early March. This escalation of trade tensions has sparked fears of a looming trade war and potential recession, sending investors scurrying from riskier assets. “The macroeconomic situation has been the main reason for the price decline,” noted one analyst, with tariff threats reinforcing inflation fears and shaking investor confidence. Safe-haven flows into U.S. Treasurys pushed yields to multi-month lows– a clear sign of growing caution.

At the same time, the crypto sector was reeling from a record-breaking exchange hack that further undermined sentiment. Just days before the ETF outflows spike, hackers stole an estimated $1.5 billion in Ether from a wallet on the Bybit exchange– one of the largest crypto heists ever. This brazen breach, attributed to a North Korea-linked group, dealt a heavy blow to market confidence. “The brutal sell-off…is not unexpected considering we’ve just seen the biggest hack in our history,” said one crypto entrepreneur, adding that it was “compounded by further fears over global tariffs”. Indeed, the Bybit hack and other industry scandals (including high-profile memecoin implosions that “brought back unhappy memories” for traders) have created a climate of caution. The fallout has reminded investors of lingering security risks in digital assets and regulatory uncertainty that continues to overhang the crypto space.

Broader risk-off behavior is also evident. As stocks and other volatile assets sold off this week, many Bitcoin ETF investors appear to have taken profits and reduced exposure. Some analysts pointed to the unwinding of the “basis trade” – a popular hedge fund strategy of longing spot Bitcoin ETFs while shorting futures – as a key technical factor. With Bitcoin’s uptrend stalling, those funds likely closed positions, forcing them to sell their ETF holdings en masse and cover futures shorts. This dynamic could help explain why ETF outflows surged so suddenly. “Lots of $IBIT holders are hedge funds [who] went long ETF, short CME futures… If Bitcoin’s price falls, these funds will sell $IBIT and buy back futures,” former BitMEX CEO Arthur Hayes warned, anticipating such an unwinding. In short, virtually every catalyst turned negative at once – from tariffs and inflation worries to cybersecurity scares and trading strategies backfiring – prompting a rapid retreat from Bitcoin investment vehicles.

Bitcoin Price Plunges to Multimonth Lows

The wave of ETF redemptions came amid a steep fall in Bitcoin’s price and a wider crypto-market rout. Bitcoin dropped below $90,000 on February 25, its first break of that threshold since mid-November. In intraday trading, the leading cryptocurrency fell as much as 7–8%, hitting lows around $87,000. By the end of the day, it was still down about 7.25% at roughly $87,170, marking a swift 20–25% pullback from its all-time high notched in late 2024. “Bitcoin has dropped nearly 20% since Trump took office in January,” noted one report, as the euphoria of the post-election rally gave way to concerns over Trump’s policies and geopolitical tensions.

The pain was even more severe for altcoins. Many smaller cryptocurrencies saw double-digit percentage losses for the week. Meme-inspired token Dogecoin and platform coins like Solana (SOL) and Cardano (ADA) each plunged around 20% in value over the past seven days. Ethereum (ETH), the second-largest crypto, fell over 7% alongside Bitcoin, though Ethereum-based ETFs reportedly saw only minimal outflows in contrast to Bitcoin’s exodus. Overall, the total crypto market capitalization sank roughly 3–4% in 24 hours during the worst of the sell-off. Leverage washed out as well – more than $1.3–$1.6 billion in bullish crypto positions were forcibly liquidated within a day as prices cascaded lower. This flood of liquidations likely accelerated the downturn, adding to the sense of capitulation.

Market sentiment indicators flashed extreme fear. The popular Crypto Fear & Greed Index, which ranges from 0 (maximal fear) to 100 (extreme greed), dropped into the low-20s, solidly in the “Extreme Fear” zone. “Investor confidence [is] declining” amid the uncertainty, one exchange CEO remarked, warning that further losses are possible if macro conditions don’t improve and regulatory concerns persist. For now, traders are treading cautiously, keeping a close eye on upcoming economic policy decisions and any signals from regulators to gauge what might come next.

Broader ETF Trends and Outlook

The startling one-day outflow from Bitcoin ETFs comes after a period of breakneck growth for these investment products. Since launching last year, spot Bitcoin funds attracted tens of billions in inflows, quickly ranking among the fastest-growing ETFs in history. Even after February’s turmoil, year-to-date net flows for crypto ETFs remain positive – over $3.1 billion of net inflows in 2025 so far. Total assets across U.S. Bitcoin ETFs still exceed $100 billion, representing roughly 5–6% of Bitcoin’s market capitalization. In other words, the structure of these funds remains intact despite the latest pullback. “The outflow numbers seem huge when you’re talking billions, but…as ~2.3% of assets, it’s not that crazy,” observed Bloomberg ETF analyst James Seyffart, suggesting the sector can absorb such bouts of volatility. He and other experts note that periodic step-backs are “par for the course” in a volatile category like crypto ETF– often two steps forward, one step back as the funds grow over time.

Still, the record-setting withdrawals highlight how sensitive crypto investor sentiment has become to the wider economic climate. “Yesterday’s $1 billion outflow was encouraging,” joked one bank’s digital assets researcher who had predicted that level might mark a local bottom, “but I don’t think the selloff is over” . Some analysts remain cautious, even forecasting Bitcoin could dip into the low-$80,000 range before finding a floor. On a brighter note, institutional adoption of crypto continues in the background – multiple asset managers filed new ETF applications (for assets like XRP, Litecoin, and others) in recent weeks, indicating sustained longer-term interest. For now, however, the focus is on the near-term fallout. The unprecedented Bitcoin ETF outflows, combined with a slumping crypto market, have dealt a psychological blow to bullish investors. If macroeconomic storms calm and industry confidence is rebuilt (helped by improved security and clearer regulation), this sharp pullback could prove a temporary setback. Until then, crypto markets are in a tenuous position, as participants digest the lessons of this “worst day ever” for Bitcoin ETFs and brace for what lies ahead.